It offers 401(k) plans, including individual 401(k), small business 401(k), and several IRA plans, including SEP and SIMPLE. Merrill Edge provides straightforward, up-front pricing, with a one-time setup fee of $390 and a monthly administration fee of $90.

So, if you’re looking for excellent business banking to go with your investment services, the Merrill Edge–Bank of America partnership can be a one-stop shop for all your needs. Bank of America, one of our best banks for small business, offers one of the best small business checking accounts on the market.

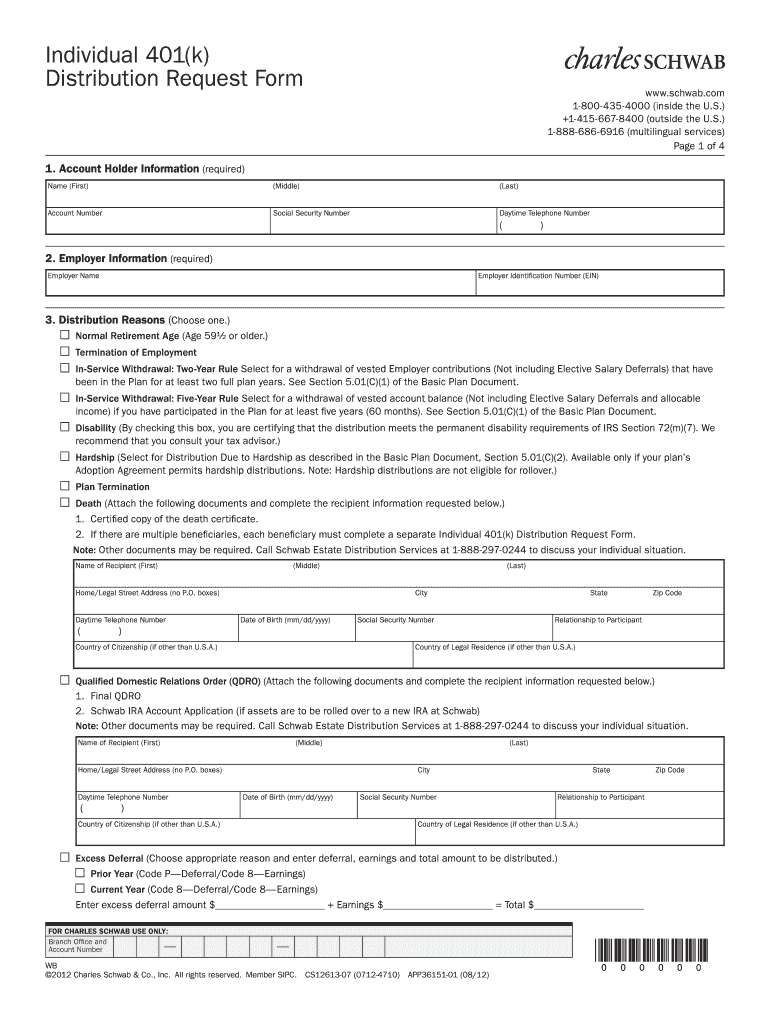

Merrill Edge is another company that provides excellent 401(k) plans with a full-service business banking experience through its Bank of America partnership. Merrill Edge: Best for Simple Pricing & Full-service Business Banking Eastern time Monday through Friday or via email. The company’s customer service can be reached via the toll-free phone number from 9 a.m. With it, small business owners can set up a plan online for a flat fee and start investing immediately. Its offerings include the lowest-cost, best-in-class investment options available. ShareBuilder 401k is an excellent option for small businesses looking to get started with 401(k) as they grow. Administration fees start as low as $25 for Solo 401(k) plans and $190 for Tiered Profit-sharing plans. It offers four different 401(k) plans: Solo 401(k), Safe Harbor 401(k), Traditional 401(k), and Tiered Profit-sharing 401(k). Whether you have just one employee or a whole corporation, it has a plan that can meet your needs. ShareBuilder 401k is our choice for the best overall 401(k) company due to its low-cost, digital-only retirement plans, making it easy for businesses of all sizes and locations to open an account. Employee Fiduciary : Best for small businesses looking for personalized service from dedicated account managers.Charles Schwab : Best for investors who want low to no fees on various trades.Fidelity : Best for owners looking for low-maintenance target date funds.Vanguard : Best for companies seeking the widest range of low-cost mutual funds.Guideline : Best for multiple 401(k) options and regulatory compliance assistance.Wells Fargo : Best traditional 401(k) provider with a highly-customizable plan.Merrill Edge : Best for simple pricing and full-service business banking.ShareBuilder 401k : Best overall for digital-only low-cost 401(k) plans.

Choosing the best 401(k) provider largely depends on the level of plan management needed, the costs and fees involved, the customer service required, and the investment options available.īased on our evaluation, here are the eight best 401(k) companies: A 401(k) plan allows you and your workforce to save up to $61,000 annually through tax-free salary deferrals, employer matching, and profit sharing. When looking to grow a small business, it’s critical to offer retirement benefits for your employees so that they can save for the future.

0 kommentar(er)

0 kommentar(er)